In 2014, when Rachel ten Brink ’01 and her co-founders launched Scentbird, a monthly digital subscription box of designer perfumes, they found their Columbia Business School connections played a vital role in their startup journey. The founders were backed by the prestigious accelerator Y Combinator. Their first office space was a sublet in the office of Liz Leahy ’96, an entrepreneur and early-stage investor. “Columbia is an incredibly important piece of my network of people I leveraged as advisors, networkers, and people who opened doors for us,” says ten Brink.

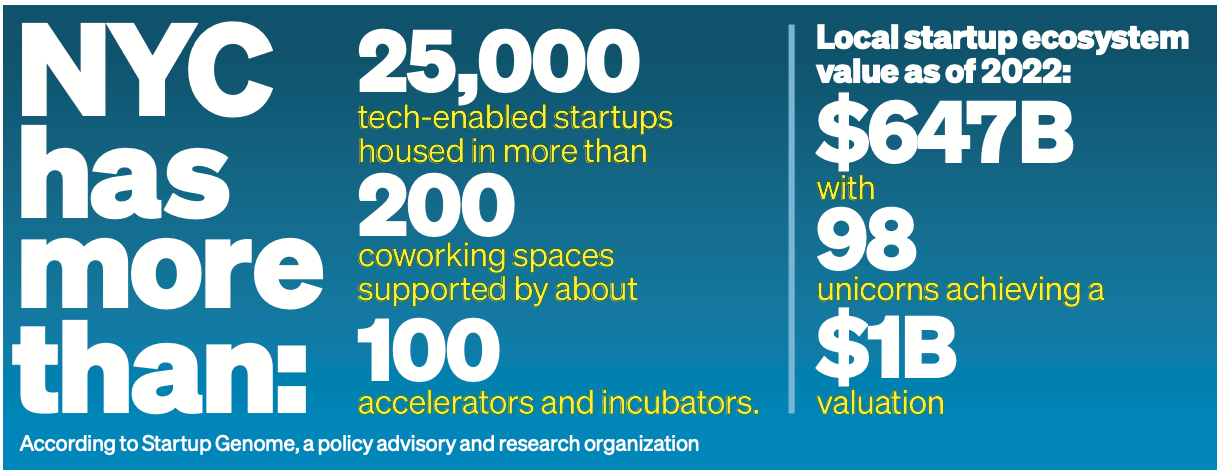

Ten Brink is one of many CBS alumni, students, professors, and staff making their mark on the vibrant startup ecosystem in New York City and the surrounding metro area—and contributing to its growth. New York City has more than 25,000 tech-enabled startups housed in more than 200 coworking spaces and supported by about 100 accelerators and incubators, according to Startup Genome. The local startup ecosystem was valued at about $647 billion as of 2022, with 98 unicorns achieving a $1 billion valuation, according to the policy advisory and research organization.

Scentbird has raised more than $29 million in venture funding—among the most raised to date by a Latina. Since then, the company has grown to more than $100 million in annual revenue.

Scentbird was ten Brink’s first startup but not her last. In 2016, she co-founded Deck of Scarlet, a successful makeup subscription service. Those wins enabled her to start angel investing and partner with Herman Goihman ’01. The team did 18 angel investments, including Hero Cosmetics, launched by Ju Rhyu ’08 and exited for $630 million in 2021. Then, in November 2021, ten Brink and Goihman started Red Bike Capital, an early-stage venture capital fund that invests in software as a service, health and wellness, and fintech. Investments include Tongo, which provides liquidity to commission-based workers such as real estate brokers, and most recently Daash, whose proprietary technology empowers brands, retailers, and investors with real-time insights.

Being located within New York City, whose status as a financial and creative capital of the world contributes to the health of its startup community, has helped the CBS entrepreneurship ecosystem grow rapidly. The School has spawned 726 venture-backed startups in the past decade, and those companies have raised $23 billion, according to the School’s Eugene M. Lang Entrepreneurship Center, which provides resources and support to students and alumni. CBS, in turn, has contributed to the local entrepreneurial economy. Some of the high-profile startups launched by students and alumni include Beyond Meat, Compass, and Happy Family Organics.

Angela Lee, faculty director of the Eugene M. Lang Entrepreneurship Center and founder of 37 Angels, an investing network that has invested in more than 100 startups, emphasizes the significance of the School’s centrality in the New York startup community. “The School really tries to be a hub to connect our students and alumni to resources.”

Ten Brink is also passionate about connecting people to resources. In May 2023, Red Bike Capital was selected by the New Jersey Economic Development Authority to manage a portion of what is described as the first-in-the-nation Black and Latino seed fund. The $20 million fund aims to increase access to capital for innovative start-ups run by diverse entrepreneurs throughout the Garden State. Ten Brink also mentors students at the Lang Center.

.jpg)

“Even when I went to Columbia in 2001, beyond being a best-in-class business school, one thing that attracted me to it was it was 30 percent women. You didn’t feel you were such a minority. There were a lot of great, super-smart women in the School who have gone on to incredible careers.”

- Rachel ten Brink '01

She was inspired in that mission by the community at CBS. “Even when I went to Columbia in 2001, beyond being a best-in-class business school, one thing that attracted me to it was it was 30 percent women,” she says. “You didn’t feel you were such a minority. There were a lot of great, super-smart women in the School who have gone on to incredible careers.”

She aims to make a difference through her work. “The way to truly bring change is to create a best-in-class firm with best-in-class returns.”

Birthing an Ecosystem

CBS is connecting current students to an entrepreneurial ecosystem that first took shape in the 1990s, according to serial entrepreneur David Rose ’83, founder of Gust, billed as the world’s largest online platform and community for entrepreneurs. He is also founder and chairman emeritus of the investment group New York Angels and a member of the advisory board of the Center on Capitalism and Society at Columbia University.

When Rose obtained his first funding round for a wireless messaging software startup from the fund Warburg Pincus in 1991, “there was a total of four tech companies in New York City,” he says. One of the others, he recalls, was IBM. But by 1995, as the software industry in the United States took off and the internet started to become available to all, access to the web was a game changer, allowing businesses to market themselves and serve customers in new ways. “Any business could get on the internet and do really useful things,” he says.

The “new media” industry soon took hold in New York City, and the companies in it bred what was to become Silicon Alley. “[The industry] was mostly comprised of agencies who were jumping in with both feet and saying, ‘Hey, we’ll build your website for you,’” Rose says. Soon there was a community of digital agencies, web shops, and software companies looking for a first-mover advantage in the burgeoning industry.

The growth of these startups gradually resulted in the industry group New York New Media Association, which grew to 6,000 members—“a lot of people for an industry that didn’t exist a few years before,” says Rose. Investors such as Esther Dyson, who became chair of the Internet Corporation for Assigned Names and Numbers (ICANN), and venture capitalist Alan Patricof MS ’57 led the charge among investors getting in on the industry. The New York New Media Association set up a fund for private investors, known as angels, as well.

Then the dotcom crash came in 2001. “It affected the tiny tech industry in New York, and basically everyone got wiped out,” says Rose. But startups and investors eventually came back—with some founders taking a detour to the venture capital world along the way—and by 2005, investors were interested in backing what became a fast-growing ecosystem. The New York New Media Association had by then been absorbed into the Software Publishers Association, so Rose and his colleagues spun off their angel fund into New York Angels, providing $158 million in early-stage funding to 318 companies.

Meanwhile, New York City elected tech entrepreneur Mike Bloomberg as mayor in 2002, and he served three terms, setting a tone that New York was open for business—and startups like Digital.NYC, the hub for startups that Bloomberg launched, began to track a lot of the new business activity in the city. Although, from a startup standpoint, New York City was “a backwater nobody ever heard of” when Rose started out, any discussion of startup investment now includes New York as one of the “two coasts,” he says. With the entrepreneurial ecosystem now including robust communities at Columbia, New York University, and Cornell-NY Tech on Roosevelt Island, he says, “the New York tech world is here to stay.”

CBS has been an active part of that world since the 1990s. Murray Low, an entrepreneur who is now an adjunct professor at Columbia Business School, joined the faculty of Columbia in September 1990 after earning his PhD at Wharton. He recalls, “I was the only person teaching entrepreneurship, other than one professor who taught it once a year.”

At first Low focused what became the Columbia Entrepreneurship Program on traditional business strategy and entrepreneurship. However, as tech entrepreneurs like Bill Gates and Steve Jobs captured the public imagination, interest in Silicon Valley-style entrepreneurship took hold among students, and that provided plenty of fodder for a more robust program. “All of a sudden, it was as if something was going on here that we should be paying attention to,” says Low.

Low and a small group of colleagues built the curriculum around practical, on-the-ground information, shared through talks by successful entrepreneurs from the community. Still, entrepreneurship education was controversial at the time, with many entrepreneurs arguing innovation skills were more of a gift than an academic subject that could be taught. And often, entrepreneurship students were torn between plum job offers from big consultancies and the like and the startup life. “Many times, students came to me and said, ‘I like this idea. I think it’s a business, but I’ve got a job offer from McKinsey and is this too high a risk? If, in two years, this doesn’t work out, where am I going to be?’” recalls serial entrepreneur Clifford Schorer, a member of the executive education faculty who worked closely with Low to build the program.

After economist and CBS Professor Glenn Hubbard got onboard, the program grew even further, adding core courses, workshops, and a host of programs to support startups. Hubbard is now CBS dean emeritus and the Russell L. Carson Professor of Finance and Economics.

“Entrepreneurship was always a bit of a fringe activity on the side, and then Glenn came along,” says Low. “It showed that there was an institutional commitment to entrepreneurship. We had people in marketing and operations, and other parts of management—everybody wanted to get in on the act—effectively taking their skills and knowledge and research and then focusing on entrepreneurship as a phenomenon. This is not economics or psychology but the teaching of entrepreneurship by many.”

From the start, Hubbard looked to differentiate the program by infusing entrepreneurial thinking throughout the whole MBA program—in contrast to Wharton, another early adopter of entrepreneurship education that instead created a separate department to teach entrepreneurship. “I had a different mission in mind,” says Hubbard. “I really wanted entrepreneurship to be throughout the entire university. Everyone should think like an entrepreneur.”

And he believed that often, the most exciting ideas come from students at other schools on campus, such as engineers and physicians, collaborating with entrepreneurs at the business school. “The University is a great laboratory for that,” he says. He also found that not everyone who wanted to learn entrepreneurship planned to apply their knowledge as a founder. “They don’t necessarily want to start a business,” he says. “They want to work in a young company.”

Hubbard believes that one critical step in the development of entrepreneurship education at CBS was the introduction of the Lang Fund. “The Lang Fund made investments,” he says. “Those investments were never very large, but the board and judges were top-flight entrepreneurs and venture capitalists. If you were pitching, you were hearing from the best of the best.”

Hubbard, who has taught entrepreneurial finance since the early days of entrepreneurship education at CBS, says he continues to believe that students can be taught skills such as identifying opportunity and business valuation. “Every entrepreneur is a general manager, and an MBA is very relevant,” he says.

"There's enormous disruption happening. New York City and Columbia are good locations for that disruption."

- Glenn Hubbard, CBS dean emeritus and the Russell L. Carson Professor of Finance and Economics

He’s focused his attention lately on artificial intelligence and its applications to fintech. “There’s enormous disruption happening,” Hubbard says. “New York City and Columbia are good locations for that disruption.”

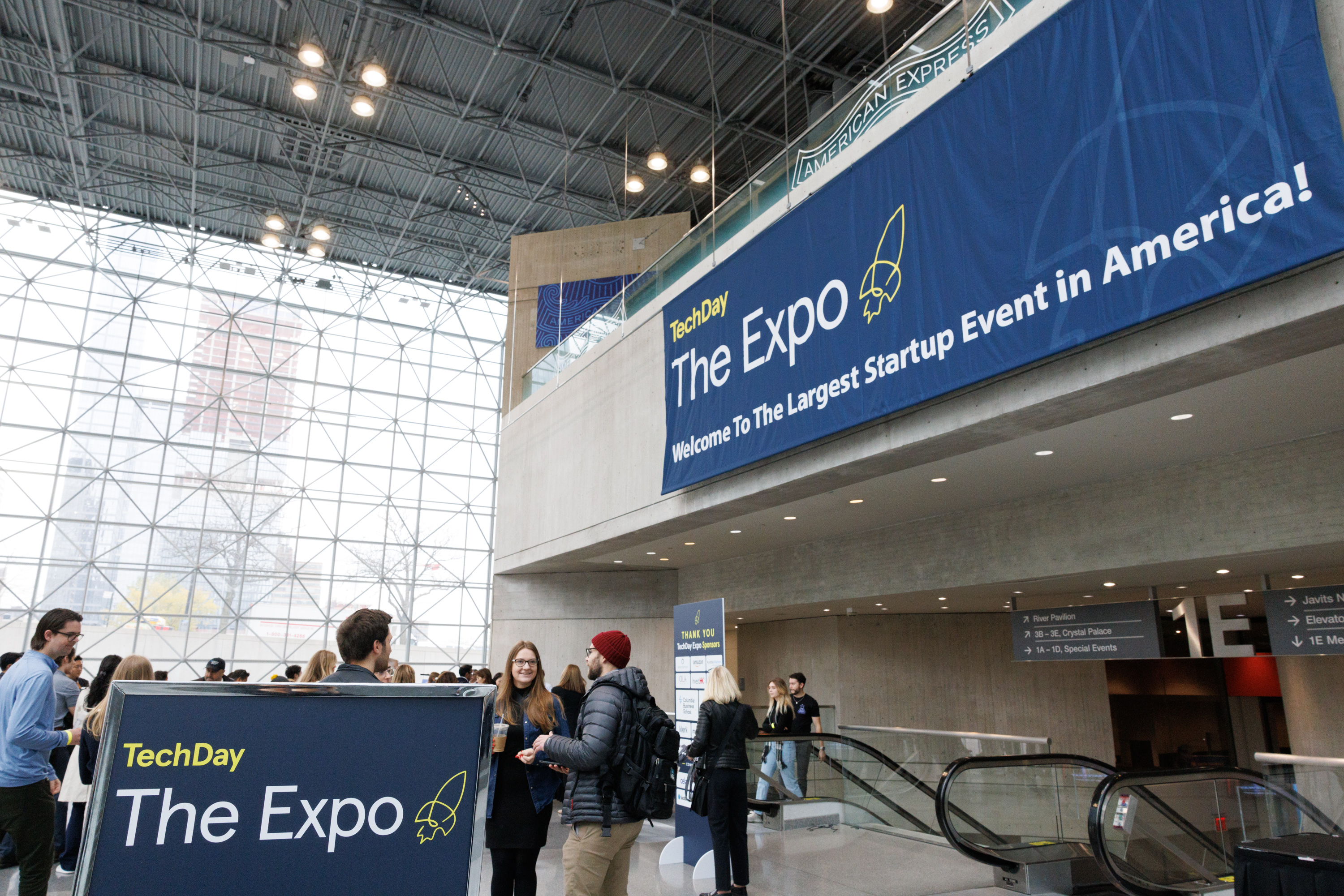

In recent years, CBS has continued its long entrepreneurial tradition through live events. Every year, the School now sponsors TechDay NY at the Javits Center, the largest startup conference in New York, with more than 35,000 attendees. CBS Startup Alley, a row of more than 40 booths at the event, highlights student and alumni-run businesses.

At this year’s Alleycon, the annual tech conference at CBS, the School brought together a panel of high-profile graduates, including Jonté Harrell ’09, managing partner at Ossian Capital. Harrell has been an active investor in startups founded by CBS students and alumni, including digital line-of-credit provider SympliFi, founded by Maurice Iwunze ’09, who won the Lang Fund Award for fall 2021, and real estate innovator Kyle Stoner ’09, founder of Unreal Real Estate. A former US Army captain, the Miami resident invested his first bonus check as a Credit Suisse trader in Betterment in 2010—a direct result of conversations with his classmate Jon Stein ’09, a fintech pioneer who cofounded Betterment and the notion of a “robo advisor.” “Columbia is an entrepreneur factory,” says Harrell. “It’s a no-brainer for me to invest early in this innovative community.”

Harrell’s quest now is to increase the support CBS provides to all entrepreneurs on campus— and to help the School leverage its powerful track record of successful student and alumni startups. He serves as CFO in residence at Columbia Startup Labs, providing direct advice to students. Says Harrell, the Labs have “been so successful, and that’s a source of growth and attraction for students.”

A More Inclusive Vision

CBS students have the chance to gain hands-on experience in various entrepreneurial business models beyond traditional startups.

Dan Wang, the Lambert Family Associate Professor of Business and faculty co-director of the Tamer Center for Social Enterprise, dedicates a significant portion of his time to involving students from CBS and other Columbia schools in extracurricular activities. These experiences complement their in-class learning and exposure to the broader entrepreneurial environment. For example, the Tamer Center operates the Inclusive Entrepreneurial Initiative, which is driven by the goal of establishing and nurturing venture ecosystems that connect local social, digital, and economic disparities.

“The impetus for this is the recognition that Columbia Business School has a lot of resources—namely knowledge capital—[and] its ability to educate and create new knowledge resources,” says Wang.

CBS also has the ability to bring together many different stakeholders and leaders across local New York City, he notes.

“What we’re hoping to do is to put students in the position of working directly with organizations that support the efforts of founders locally—entrepreneurs and small business owners who are otherwise excluded or face immense barriers to accessing resources,” says Wang. With this in mind, the Inclusive Entrepreneurial Initiative is currently working to connect MBA students with accelerators that support underrepresented founders, as well as enable them to work directly with local businesses. “It’s a mutual path for learning,” says Wang.

In one recent project, the students are collaborating with Kente Royal Gallery in Harlem to help artists represented there to commercialize their work more effectively. “This literally means ‘How do you sell more effectively? How do you market more effectively? How do you strategize about the future for this gallery?’” Wang says.

Last year, the Inclusive Entrepreneurial Initiative piloted a program in which it offered the outline of a curriculum for small business clinics. In these pop-up events, students with expertise in entrepreneurship or financial literacy help current and prospective small business owners address operational questions. In 2023-2024, the program will expand to include support from students at Columbia Law School, which operates legal clinics. “It’s a wonderful complement,” says Wang.

He believes the Inclusive Entrepreneurial Initiative will ultimately become a powerful driver of innovation.

“There’s this whole other sector of the economy that is based in local entrepreneurship or community entrepreneurship that hasn’t really gotten a lot of attention in business education, especially at places like Columbia Business School,” he says. “But as it turns out, some of the most novel ideas that accelerate the economy come from local problems and local solutions. So, it’s a wonderful learning opportunity for students, and my sense is that a lot of them benefit from this because it’s a structured program that engages them in a form of thinking that they might otherwise have not become familiar with in their educational experiences or in their careers.”

Other unique educational experiences at CBS include the on-campus Small Business Development Center (SBDC), one of 900 centers across the country that offer free business advice and workshops to existing and future entrepreneurs. “New York City is a hub destination for entrepreneurs and investors alike, and I believe CBS plays a big part in fueling the entrepreneurial ecosystem in the city,” says Lara Hejtmanek ’99, managing director of the Lang Entrepreneurship Center.

"New York City is a hub destination for entrepreneurs and investors alike, and I believe CBS plays a big part in fueling the entrepreneurial ecosystem in the city."

- Lara Hejtmanek '99, managing director of the Eugene M. Lang Entrepreneurship Center

In addition to programming for students, the Lang Center has invested in extensive programming and support for alumni who are either launching or scaling startups. This programming includes Columbia Alumni Virtual Accelerator (CAVA), an eight-week virtual accelerator including workshops, coaching, and intense peer support sessions. The center also runs events such as dinners to foster connections among the founder community.

Hejtmanek views the Lang Center as a microcosm of New York City. “We are constantly connecting students, alumni, and faculty with each other,” she says. “These connections often develop into deeper relationships—many of our alumni serve as advisors on, invest in, or support CBS startups in various ways. These same kinds of connections happen organically throughout our alumni community. It’s probably most felt in New York City since, according to LinkedIn, over half of CBS alums stay in the NYC area after graduation.”

That fosters ongoing connections with the School. “We have a strong alumni presence in venture capital, angel investing, accelerators, venture studios, corporate innovation, and more,” notes Hejtmanek.

“And our alumni are not just present in the ecosystem—they are being recognized for their contributions to making the ecosystem stronger, more dynamic, and more inclusive,” she says. “Many of our alumni are committed to funding and supporting underrepresented founders—for example, Professor Lee’s 37 Angels is committed to closing the gender gap in angel investing, one that is narrowing, with the angel community now 34 percent female, according to the Angel Capital Association. Liz Leahy ’96, an alum and Lang Center board member (who helped ten Brink find her office space years back), founded Purple Sage Ventures, which focuses on supporting startups with underrepresented minority founders.”

Purple Sage, for example, has backed Guava, a startup that aims to close the racial wealth gap and increase financial equity with a digital banking and networking platform aimed at Black small business owners. Guava was founded by Kelly Ifill ’17, who once led public school math departments before attending CBS to pivot to ed-tech investing. Another portfolio company is ToTheMarket, a technology-enabled B corp that brings transparency to the supply chain with end-to-end workflow management, started by Jane Mosbacher Morris ’12.

Entrepreneurship is also a theme in CBS’s farflung alumni chapters around the world. Next March, for instance, Lee will be teaching Foundations of Venture Capital for the first time in Tokyo. “We are meeting with about a dozen investors and founders, several of whom are CBS alumni,” says Lee.

The School’s entrepreneurship educators are happy to oblige. “There is an insatiable demand for CBS founders to meet, network, and support each other,” says Hejtmanek. “Entrepreneurship is a lonely journey. We get that and are working hard to find more and bigger ways to facilitate connections and build relationships.”